What causes Companies to Lead and Surrender?

Motorola was the largest mobile phone manufacturer before Nokia took over in 1998. Before this, Motorola was the leading manufacturer of two-way radios with the first radios installed in police cars in 1930. Nokia had been in mining, produced rubber galoshes and went into telephony in the 1960s. In 1999, Nokia was first to offer a web browser on a mobile phone but failed to stand up to new rivals.

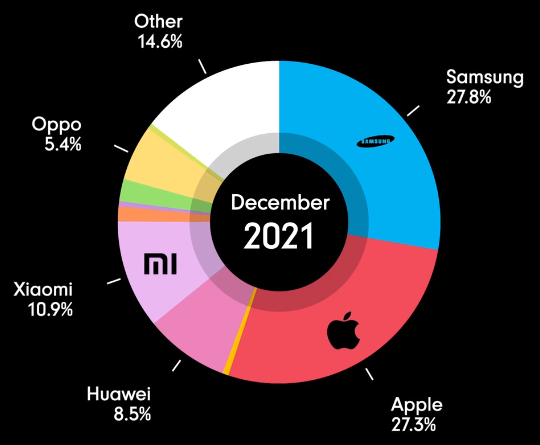

Apple was not alone putting the mobile phone market on its head. The Android mobile operating system gave Samsung, Huawei and Xiaomi a global foothold. A presentation captures cellphone winners and losers in the last 30 years.

Battery adapters serving as last-mil

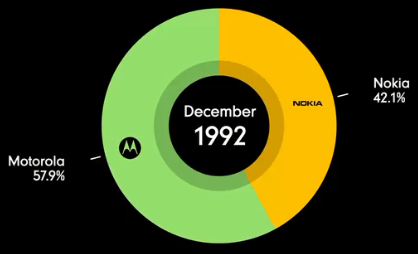

With a 58% market penetration, Motorola owned the mobile phone market in 1992; Nokia had a respectable 42%. These clunky analogue phones with NiCd batteries were prone to failure and the C7 battery analyzer was in high demand to test and rejuvenate these batteries.

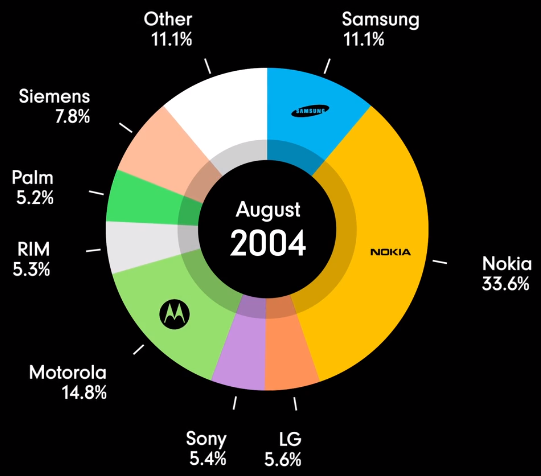

Switching to digital cell phones, Motorola lost to newcomers while Nokia maintained a market share of 34% up to 2004. I traveled many times to Nokia in Finland, Ericsson in Sweden and global Motorola offices to present our new rapid-test technologies. The C7 was increasingly being used for storefront service to rapid-test batteries.

New arrivals emerged in 2004

New players in 2004 were Palm, RIM, Sony, LG, Siemens and Samsung. When Apple introduced the smartphone in 2007, people asked, “What’s a computer company doing in the cellphone market? Apple succeeded in part because of its software skills that Motorola and Nokia could not uphold. Today, the market share between Apple and Samsung is 27% with Chinese rivals entering the space.

Today Apple and Samsung are the main players

“What causes cellphone manufacturers to grow and shrink?” we ask. Motorola had a lead in making rugged two-way radios while new digital mobile phones included a camera, internet browsing, listening

to music and using the phone as a computer. Pro-active marketing with the personal touch of Steve Jobs also helped.

Cadex is also going through a digital revolution by connecting battery analyzer and charger to the cloud. We attain competitive pricing with the hybrid model through minimizing. Cadex products will continue to operate in stand-alone mode with scalability to view detailed battery State-of-Health (SoH) on a tablet and reveal the Remaining Useful Life (RUL) of batteries on a PC monitor with cloud analytics.

Becoming a leader in the mobile phone market reveals strong Product Management with visionaries and building of robust business models. Apple devoted all resources to perfect one phone whereas Motorola was working on dozens of phone models at once. Obligations towards OEM at Cadex and meeting the Product Release Dates places high demands on our staff.

Diagnostic Battery Management (DBM) does not have the same market potential as mobile phones, but one component is in common: the battery. The capacity of this energy storage device decreases with usage and age. Tracking the loss and scheduling replacement requires DBM, a function Cadex includes in next-gen diagnostic chargers and analyzers.

Installing the first Motorola radio in a police cruiser in 1930 enabled voice communication with the base. Making battery SoH transparent to fleet supervisors realizes this need 100 years later. Advanced battery management lowers the total cost of ownership by fully utilizing each battery while improving system reliability. Keeping batteries in service longer protects the environment.